Philip Morris (Thailand) Takes 500 Million Baht More but Protests Tax Increase on Cigarettes

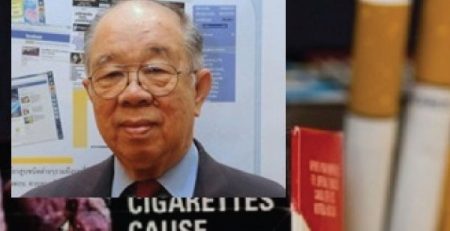

Philip Morris (Thailand) Takes 500 Million Baht More but Protests Tax Increase on Cigarettes Prof. Dr. Prakit Vathesatogkit, the Executive Secretary of the ASH Thailand pointed

out that Philip Morris (Thailand) increased their cigarette prices so they could gain 500 million baht more in profit per year while they protest the increasing tax on cigarettes. Philip Morris (Thailand) previously announced an increase in their cigarette prices for L&M and Marlboro from 66 baht to 67 baht and from 90 baht to 92 baht. The increase of these cigarette prices resulted in Philip Morris (Thailand) earning more profit; at least 500 million baht more than the 2,900 million baht earned in the previous year according to an estimate by Thai academic staff working with WHO officials following cigarette sales of Philip Morris (Thailand) in 2012.

At the same time, Philip Morris (Thailand) produced a campaign to protest the tax increase on cigarettes of the Ministry of Finance through Facebook, Thai Smoker Community, and invited smokers to express their opinions on the issue of increasing taxes on cigarettes to the government. They displayed charts showing the structure of the tobacco excise tax which indicated too high a tax collected in Thailand. At the end of last year, Philip Morris (Thailand) publicized research conducted by the International Tax and Investment Center (ITIC), a non profit organization serving as a clearinghouse for information on best practices in taxation and investment policy, and which has published information on smuggled cigarettes in 11 countries in the Asia Pacific region including Thailand. This research news indicated that the average loss to smuggling in the Asia Pacific region and Thailand was 9.0% and 2.9%. In addition, Philip Morris (Thailand) quoted this research stating that the most important cause of a high level of cigarette smuggling was the fact that cigarette taxes were too high in the region and Thailand. However, it was discovered that the research by the ITIC was funded by Philip Morris, and independent academic researchers found that research results were based on unreliable research methodologies.

Moreover, internal documents of Philip Morris (Thailand) also indicate that the company protests increases in cigarette taxes because such tax increases result in a decline in their sales. For this reason, it is interesting to follow news of increases in cigarette prices for major Philip Morris cigarette brands (L&M and Marlboro) to determine whether price rises are one of the strategies of Philip Morris to argue against government cigarette tax increases. The last cigarette tax increase was in August 2012 and the Ministry of Finance typically raises the tobacco tax every two years in an attempt to control tobacco consumption according to the request of the Ministry of Public Health.

Request more information, please contact:

Prof. Dr. Prakit Vathesatogkit, Action on Smoking and Health Foundation (ASH Thailand),

Tel.: +66-2278-1828 / +668-1822-9799